As best home improvement loans with low interest take the spotlight, readers are invited to delve into a realm of knowledge tailored to ensure an informative and engaging read.

In the following paragraphs, we will explore the intricacies of home improvement loans, factors to consider when choosing one, researching lenders, and the application process.

Understanding Home Improvement Loans

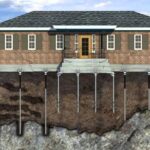

Home improvement loans are financial products designed to help homeowners fund renovations, repairs, or upgrades to their homes. These loans provide a convenient way for individuals to make improvements to their properties without having to pay for the entire project upfront.

Types of Home Improvement Loans

- Personal Loans: These are unsecured loans that can be used for various purposes, including home improvement projects. They typically have higher interest rates compared to secured loans.

- Home Equity Loans: These loans use the equity in your home as collateral. They have fixed interest rates and can be a good option for larger projects.

- Home Equity Line of Credit (HELOC): Similar to a credit card, HELOC allows you to borrow against the equity in your home. You only pay interest on the amount you use.

Difference between Secured and Unsecured Home Improvement Loans

Secured home improvement loans require collateral, such as your home or other assets, to secure the loan. This lowers the risk for the lender, resulting in lower interest rates and higher borrowing limits. On the other hand, unsecured loans do not require collateral but come with higher interest rates and lower borrowing limits.

Factors to Consider When Choosing a Loan

When looking for a home improvement loan, it is crucial to consider various factors to ensure that you choose the right option for your financial situation. Two key factors to focus on are the interest rates and loan terms.Interest rates play a significant role in determining the overall cost of your loan.

A lower interest rate means lower monthly payments and less interest paid over the life of the loan. Therefore, it is essential to compare interest rates from different lenders to find the most competitive offer.Loan terms also impact the affordability of the loan.

The term refers to the length of time you have to repay the loan. While a longer-term may result in lower monthly payments, it can also mean paying more interest over time. On the other hand, a shorter-term may have higher monthly payments but lower overall interest costs.

It is essential to choose a loan with terms that align with your financial goals and capabilities.

Eligibility Criteria for Low-Interest Home Improvement Loans

When applying for low-interest home improvement loans, lenders typically have specific eligibility criteria that borrowers must meet. Some common requirements include:

Good credit score

Lenders often offer lower interest rates to borrowers with good credit scores, as they are considered less risky.

Stable income

Lenders may require borrowers to have a stable source of income to ensure they can repay the loan.

Loan-to-value ratio

Lenders may consider the loan-to-value ratio, which is the amount of the loan compared to the value of the property. A lower ratio may result in better loan terms.

Debt-to-income ratio

Lenders may also look at the borrower's debt-to-income ratio to assess their ability to manage additional debt.By understanding these factors and eligibility criteria, you can make an informed decision when choosing a low-interest home improvement loan that best suits your needs.

Researching Lenders

When looking for the best home improvement loan with low interest rates, it's essential to research and compare lenders to find the most competitive options available. Here are some tips on how to go about it:

Comparing Interest Rates and Terms

To effectively compare lenders, create a table listing the interest rates and terms offered by different financial institutions. This will allow you to see the differences in rates, repayment terms, and other crucial factors at a glance.

| Lender | Interest Rate | Loan Term |

|---|---|---|

| ABC Bank | 3.5% | 5 years |

| XYZ Credit Union | 4.0% | 7 years |

| 123 Mortgage Company | 3.75% | 10 years |

Reputable Financial Institutions

Here is a list of reputable financial institutions that are known to offer competitive home improvement loan rates:

- ABC Bank

- XYZ Credit Union

- 123 Mortgage Company

- DEF Savings and Loan

- GHI Federal Credit Union

Application Process

When applying for a home improvement loan, there are several typical steps involved in the application process. It is important to be prepared with all the necessary documents and understand the timeline from submission to disbursement of the loan.

Checklist of Documents

- Proof of income: Pay stubs, tax returns, or bank statements

- Property information: Title deeds, property assessment, and insurance details

- Identification: Driver's license, passport, or social security number

- Credit history: Credit report and score

- Loan application: Completed application form

Timeline from Application to Disbursement

It is important to note that the timeline for loan disbursement can vary depending on the lender and the complexity of the application.

- Application submission: Once you submit your application with all the required documents, the lender will review your information.

- Approval process: The lender will assess your creditworthiness, income, and property details to determine if you qualify for the loan.

- Loan processing: After approval, the loan will go through processing where the terms and conditions are finalized.

- Loan disbursement: Finally, once the loan is processed, the funds will be disbursed to you or directly to the contractor for your home improvement project.

Concluding Remarks

In conclusion, navigating the landscape of best home improvement loans with low interest can be daunting, but armed with the right information, you can make confident decisions to enhance your living space.

FAQ Compilation

What are the eligibility criteria for low-interest home improvement loans?

Eligibility criteria may vary, but generally, lenders look at credit score, income, existing debts, and the value of your home.

How do I compare lenders offering low-interest home improvement loans?

Research online, check reviews, compare interest rates, loan terms, and fees to find the best option for your needs.

What documents are typically needed for a home improvement loan application?

Common documents include proof of income, credit history, ID, proof of homeownership, and details of the planned renovation.